Series I Savings Bonds

Originally submitted in the Upbeat Wealth November 2021 Newsletter. Click HERE to subscribe for more articles like this + exclusive content straight to your inbox.

What are Series I Savings Bonds?

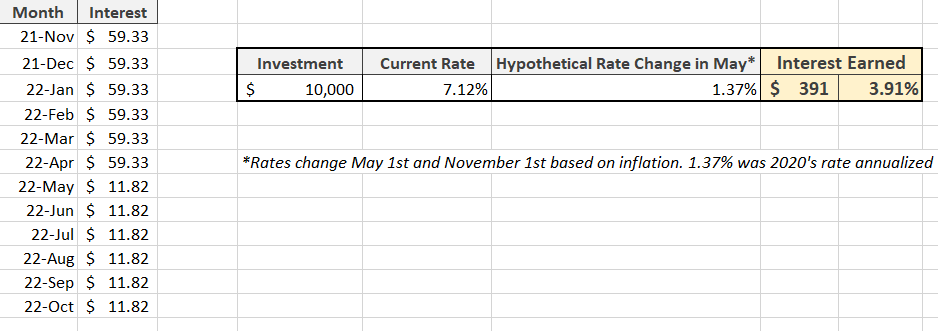

Offered by the Treasury Department, these bonds are based on a fixed rate and an inflation rate. Given the high inflation rate environment, the current interest rate you can earn is 7.12%. How is this rate determined? It’s Fixed Rate + Inflation Rate. The fixed rate remains with I bonds as long as you hold them and is 0% at this time. However, the inflation rate is running at 7.12%, or more accurately, 3.56% semiannually. In May, the bonds will be adjusted to the inflation rate at that time. However, you are guaranteed the 3.56% semiannual inflation rate for the first (six) 6 months you hold the bonds. So if you purchase in December, they wouldn’t be subject to the new May rate change until June. Additionally, the interest compounds semiannually. Therefore, after six (6) months, the earned interest from your I bonds will be added towards the principal value. You’ll then begin earning interest on that increased amount.

How is the Inflation Rate Determined?

The inflation rate for I bonds is tied to the non-seasonally adjusted Consumer Price Index for all Urban Consumers which factors in all items, including food and energy. Here's a historical chart showing the rates of I Bonds. As you can see, the last time the rates of I bonds exceeded 7.12% was in May of 2000.

Any Other Benefits of Series I Savings Bonds?

Backed by the full faith and credit of the U.S. government

Not taxed at the State or Local level

Not taxed at the Federal level IF used for qualified higher education expenses

What's the Downside?

$10,000/max purchase per taxpayer per calendar year

Funds subject to a twelve (12) month lock-up period

If funds are redeemed before five (5) years, the individual forgoes the previous three (3) months of interest

Rates are adjusted semi-annually and will change in May

How About an Illustration?

Below illustrates the rate of return for an investment of $10,000 held for a period of twelve (12) months. The calculation takes into account the forgone interest of the last three (3) months since the bonds are hypothetically redeemed prior to five (5) years. Also, the calculation shows a hypothetical rate change of 1.37% taking place in May 2022. Investors would still earn a 3.91% nearly risk-free.

How Do I Purchase?

They must be purchased directly through the TreasuryDirect.gov website. Starting an account, linking your bank account, and purchasing the bonds takes ten (10) minutes of time.

Are Series I Savings Bonds Right for Me?

This is only an educational look at I bonds and not a solicitation to purchase them. To learn more about I bonds, please visit the TreasuryDirect.gov website and consult with your financial professional on whether they are right for you.