Foggy Glasses: Investing in Bitcoin

Originally submitted in the Upbeat Wealth October 2021 Newsletter. Click HERE to subscribe for more articles like this + exclusive content straight to your inbox.

In September, I had the opportunity to speak with Jeanne Sahadi at CNN Business about “what to know before you invest in crypto”. Fast forward to October which has been a month to remember for the polarizing cryptocurrency.

Bitcoin has since “mooned” to an all-time high ($66,909.15). Furthermore, the SEC approved the first wave of Bitcoin Futures ETFs, and investors were eager to add shares to their portfolios. Below is a chart from Ben Johnson at Morningstar depicting the ProShares Bitcoin Strategy ETF (Ticker: BITO) becoming the fastest ETF to gather $1 billion in assets.

While we can’t be certain that my September comments regarding speculative cryptocurrency investing with a life partner and October’s surge in price aren’t directly correlated, I thought they were worth backing up, clarifying, and building upon.

Foggy Glasses: Is Bitcoin a Good Investment?

If a conversation surrounding the digital blooming onion (little Outback Steakhouse humor there) breaks out amongst my peers, there’s a high probability someone ultimately turns to me with the impossible question, “Is bitcoin a good investment?”. Which can be translated to “Should I be investing in bitcoin?”. And I should be so lucky to always have a Foggy Glasses Double IPA from my neighborhood brewery, Parleaux, when it occurs. A beautiful hazy IPA rich with citrus notes – perfectly crafted and named for this month’s topic.

My answer as a CFP® and APMA® tends to be foggy and extremely delicate because, for most people, serious investment into cryptoassets is not a light decision. It is financial plan altering. Excluded from this audience are those making purchases around 1% of their income or overall portfolio. I'm talking about those looking to make speculative investments of 5% or more as a serious strategy to build wealth. Let's dive in.

Forget Good. Is Bitcoin an Investment?

In Warren Buffett’s 2011 Letter to Berkshire Hathaway Shareholders, he defined investing “as the transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power in the future”. He went even further diminishing gold owners as “not inspired what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future”.

Bitcoin is oft referred to as digital gold - a store of value not subject to manipulation by fiscal or monetary policy. The original whitepaper on bitcoin describes it as a peer-to-peer currency that cuts out costly middlemen and reduces fraud. The joke on Financial Twitter is when bitcoin is gaining value, the fanatics megaphone the price in dollars, and when it loses value, well, 1 bitcoin is 1 bitcoin.

In the United States, the idea of it being a free peer-to-peer currency doesn't feel as necessary or urgent as it may in countries with authoritarian regimes. Places where you can't really trust a bank to keep your money safe from being wrongfully confiscated or living within the confines of a heavily volatile economic backdrop. And, honestly, we already have instant and free peer-to-peer services in the U.S. like Venmo, Cash App, Zelle, etc. Additionally, domestic regulations deter users from transacting with cryptocurrency since it’s treated as a security, not a currency, and any gains, as a result, are subject to capital gains taxes.

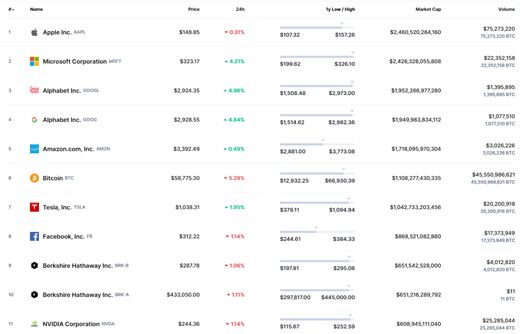

No one can predict how far scarcity, momentum, and perceived utilitarian value can carry bitcoin in the future. But presently, the collective belief surrounding it is incredibly strong. According to this data by CoinMarketCap, Bitcoin would be the 6 biggest company by market cap.

By further comparison, actual gold has a market cap of around $10 trillion (price multiplied by reserves). Gold is traditionally viewed as a fear index or inflation hedge. The cult-leading gold bugs are usually split between pushing their audiences to acquire gold due to the imminent reckoning or the ticking national debt clock. Luckily, they and their partners will sell to you for a great price!

Blockchain’s First Experiment

What is clear is that bitcoin is the first experiment utilizing blockchain technology, a space that is now exploding with prospects of utility. Banks, tech behemoths, and social media giants have all tried to make use of the blockchain technology demonstrated by bitcoin.

And then there is the cohort of blockchain projects born from bitcoin’s popularity. One of the most popular is ethereum. Think of it as Apple’s iOS in a sense where other developers can use the ethereum platform to create their own blockchain applications. Applications are spread across finance, art, education; you name it, there's a project for that. By utilizing blockchain technology, users create content or value and maintain full control of distribution and monetization.

Inevitably, there will be winners and losers amongst blockchain applications including failed projects, bad actors, and straight-up fraud. But will bitcoin - the cryptocurrency that sparked it all - continue to be viewed as the key to unlocking the next generation of web applications?

Purchasing Actual Bitcoin vs. a Bitcoin Futures ETF

This has been a testy subject among the financial community. While an ETF that tracks futures contracts is not as ideal as one that holds actual bitcoin - it’s not all doom and gloom. Yes, purchasing bitcoin directly is the best course of action IF you are technologically savvy enough to buy it on a platform with low trading fees, can operate a physical hardware wallet for safekeeping, and don’t mind the inconvenience of holding what you hope to be an appreciating asset in a taxable account.

While futures ETFs are complex operations and retail investors should be informed before investing, it is a convenient way to gain exposure in a SIPC insured account. Sure, BITO the largest bitcoin ETF charges 0.95% (more than what clients pay Upbeat Wealth for our holistic investment management services), but the #1 cryptocurrency trading platform, Coinbase, also levies big fees on trades. For instance, if you were just dollar-cost averaging $100/month into bitcoin, you could be paying around 3% in transaction costs and additional hidden fees in the spread.

Most importantly, it's important to speak with a trusted fiduciary when determining if an investment in cryptocurrency makes sense for you. It's one thing to have the risk tolerance, it's another to have the risk capacity.